The views expressed are those of the authors at the time of writing. This information does not constitute, and should not be construed as, an offer of advisory services, securities or other financial instruments, a solicitation of an offer to buy any security or other financial instrument, or a recommendation to buy, hold or sell a security or other financial instruments in any jurisdiction.

By Luke Chan, Partner, Head of Private Credit

Traditional direct lending has attracted significant investor interest and now represents a majority of private credit assets. However, direct lending is not without risks and we think there are benefits from diversifying credit exposure away from levered corporates, which comprise direct lending’s collateral base. As a result, we believe that specialized lending, with its wide array of diverse collateral, presents itself as an ideal complement and can serve as a bedrock of a private credit portfolio.

Direct Lending’s Heyday

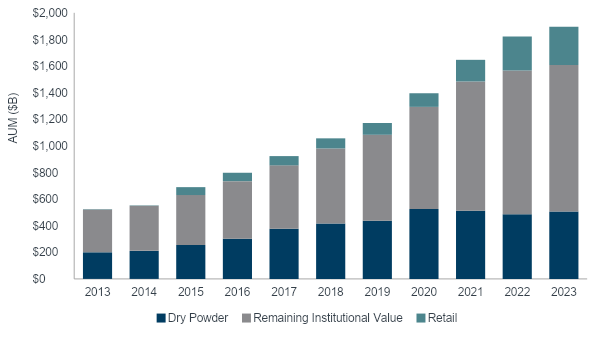

Investor interest in private credit has ballooned in recent years, to the extent that allocations to the asset class now constitute nearly $2 trillion of AUM, with growth expected to continue for the foreseeable future. The bulk of investor allocations to private credit reside in traditional direct lending—highly leveraged loans to corporates that generally have been subject to leveraged buyouts or dividend recaps. Notably, the growth in direct lending has coincided with the expansion in broader private equity AUM. These two asset classes go hand-in-hand as direct lending is where the “leverage” in “leveraged buyout” comes from!

Exhibit 1: Private Debt AUM 1

1 Source: PitchBook’s 2023 Annual Global Private Debt Report, as of 06/30/2023.

By and large, investors have been rewarded for their allocations to traditional direct lending as loans in the space generally offer higher coupons relative to public or broadly syndicated credit markets, while also exhibiting floating rates and better covenants than what is available in traditional high-yield fixed income (which in many cases have no covenants or are so-called “covenant-lite”). In addition, traditional direct lending is a relatively easy area in which to build substantial scale. There is no shortage of lenders offering corporate direct lending strategies and there appears to be virtually no limit to the appetite on the part of private equity-backed corporate borrowers for debt capital. Thus, it is not surprising that traditional direct lending often constitutes the first port of call for investors seeking to build out their private credit portfolios.

Too Much of a Good Thing?

Traditional direct lending may be a good starting point for an investor’s private credit portfolio but should it be the sole component? While the asset class has significant advantages, investors should consider its potential pitfalls:

- Correlation: Investors shouldn’t lose sight of the fact that the counterparties in their direct lending portfolios can be the same companies that comprise their private equity and buyout portfolios. While more senior in the capital stack, traditional direct lending relies on the performance of small-cap, levered corporates for their creditworthiness and ultimate return potential. This can result in doubling down on the same risk factor when taken into context with an investor’s existing buyout and broad equity portfolio.

- Competition: The rise in traditional direct lending AUM has undoubtedly driven increased levels of competition. Over the past decade, direct lending has benefitted from several factors including a tailwind of relatively low initial market share in credit markets, the retrenchment of banks post-GFC, and oftentimes dislocated leveraged loan and structured credit markets. However, now that the asset class has scaled dramatically and by some measures rivals the U.S. high-yield bond and leveraged loan markets in aggregate size, it has run into the problem of return compression. For instance, spreads in traditional direct lending, as compared to broadly syndicated loans, have contracted to just over 2% from an historical average of close to 4%2, and recent press has made note of the resurgence in competition from bank lenders seeking to win back market share from private lenders.

- Collateral Quality: How creditworthy is the collateral in direct lending? While the performance of traditional direct lending has been strong over the past decade, there hasn’t been a truly sustained economic contraction during this period as downturns have been shallow, short, or papered over with massive governmental stimulus. On the other hand, collateral quality may be deteriorating as the valuation levels of buyout deals, as measured by multiple of EBITDA, have been steadily creeping up over the past decade while the quality of EBITDA may be eroding. For instance, the average EBITDA adjustment/add-back for LBO deals now represents around 50% of headline reported EBITDA3. Similarly, one study found that the average credit quality in the direct lending market was equivalent to a single-B or CCC rating4. These factors may augur a vulnerability to future macroeconomic turmoil that is not reflected in headline performance and leverage numbers.

2 Source: Lincoln International Q2 2023 Lincoln Senior Debt Index.

3 Source: S&P Global Ratings: “Leveraged Finance: Fifth Annual Study of EBITDA Addbacks Finds Management Continues to Regularly Miss Projections”.

4 Source: Morgan Stanley: Deciphering the Credit in Private Credit.

These factors, when taken together, should give investors pause. One investment belief underpinning private credit allocations is that the asset class will exhibit resilient returns in the face of macroeconomic adversity. When equity portfolios are struggling, it should be credit that saves the day. Yet for traditional direct lending, it remains unclear whether it is well-positioned to fulfill this role given the dramatically increased availability of capital in the sector combined with its inherently correlated and volatile source of collateral. Only time, and perhaps a sharp recession, will answer this question. In the meantime, we think diversification of private credit portfolios beyond traditional direct lending is prudent, if not required.

The Opportunity in Specialized Lending

The good news for investors is that credit markets, akin to the economy in general, are much broader than loans to highly leveraged, private equity-backed companies, but it will take some legwork to figure out the “right” areas to invest in. Investors able to look beyond the traditional spaces of private credit may find opportunities in one of the many “specialized lending” areas that exhibit some combination of higher returns (coupons or spreads), diversifying risk profile (relative to traditional alternative investments), and better credit protection from adverse events (via better collateral and structure).

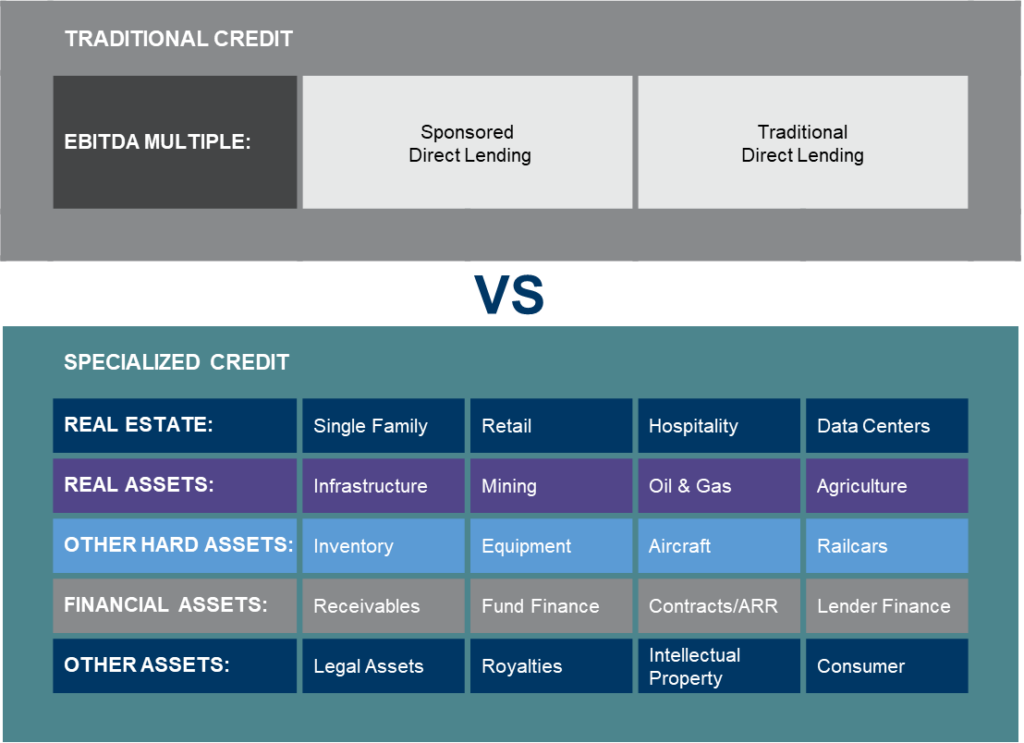

Contrary to traditional direct lending, where investors rely on a single “collateral type” (lending against EBITDA), there are many different specialized lending areas that offer varying collateral types that an investor may choose from. These include lending against forms of hard collateral that may be liquidated, lending against value that is not EBITDA-based, or lending to non-corporates and other specialty assets. With our emphasis on fundamental credit discipline, we believe it can be useful to categorize these areas by the type of collateral involved—what exactly are you lending against?

Exhibit 1: Private Credit Themes by Collateral Type5

5 Provided for illustrative purposes only to demonstrate the breadth of private credit themes by collateral type, no representation is made here about the potential profitability of any specific investment or investment theme. Please refer to the important disclosures at the end of the paper.

Seen from this perspective, investors may intuit that certain forms of collateral might be more attractive than others—perhaps lending against cryptocurrency poses a different credit proposition than lending against apartments. We believe selecting specialty credit areas may offer the dual benefit of: 1) higher returns, due to less competition; as well as 2) a low level of risk if the collateral and credit structuring are high quality. At a portfolio level, we think private credit portfolios should be secured against a mixture of collateral types to maximize the benefits of diversification and protection from adverse events.

Investors should understand that executing on a diversified specialized lending program is not as simple as investing in traditional direct lending as these areas are harder to identify and diligence. However, with enough attention, effort and investment flexibility, investors can position themselves to succeed. We think a playbook should include:

- Prioritizing the most attractive specialized areas: First, investors should study each target vertical within specialized credit to determine its attractiveness. Just because an area is different from traditional private credit does not mean it will be more attractive, and in fact many may be less attractive. Investors should understand that each specialized area operates under its own set of rules and market norms. To gauge attractiveness, we think investors should focus on areas that offer contractual returns that meet their objectives while scrutinizing the collateral and covenant packages that are received. In striving for premium returns, we favor areas with a capital supply-demand imbalance from either capital flight or high barriers to entry.

- Pick your partners: Second, investors should take care in evaluating and structuring relationships with their lending partners. We believe that partner selection within specialized lending is extremely important as successful lending requires expertise and a bespoke structuring approach, unlike traditional credit markets where underwriting and structure may be more standardized.

- Diversify: Third, we think investors are best served investing across a portfolio of specialized lending areas. Unlike traditional direct lending, which represents broad economic exposure, specialized lending areas tend to exhibit idiosyncratic risk factors. Fortunately, specialized lending portfolios that are curated across borrowers and themes ought to be more resilient against broad macroeconomic factor risk.

Ultimately, we believe that the opportunity for value-creation in specialized lending is substantial. Specifically, we posit that thoughtful investors may be able to avoid traditional direct lending’s three obstacles described earlier, due to the following reasons:

- Returns may be higher, as capital competition has the potential to be significantly lower than in traditional credit markets, leading to more opportunity for higher contractual returns.

- The risk may be lower, given many specialized areas offer high-quality collateral and the opportunity to originate well-structured loans with strong covenants and a direct ability to enforce.

- Genuine portfolio diversification may be gained as these specialized lending areas are often uncorrelated with one-another as well as to the broader macroeconomic environment.

We acknowledge that successfully executing within specialized lending requires more effort than investing in traditional direct lending. However, we believe that the result of doing so is differentiated alpha, which has become especially valuable in a world of ever-increasing competition.

Luke Chan, Partner, Strategic Capital, & Co-Head of Private Credit

Luke is a Partner and Head of Private Credit at HighVista Strategies. He leads the firm’s investing across its specialty private credit and opportunistic credit verticals. In addition, Luke also concentrates on strategic investments including partnerships with teams that bring differentiated investment capabilities to HighVista’s portfolios and clients. Prior to joining HighVista in 2014, Luke was an analyst at RBC Capital Markets in their Global Investment Banking group, where he specialized in transactions across the real estate sector. Luke received a BS summa cum laude from Cornell University.

Important Disclosure

This presentation is provided for informational purposes only, is general in nature, and is meant only to provide a broad overview for discussion purposes. The information expressed herein reflects the judgments and opinions of the authors at the time of writing, does not purport to be complete, has been excerpted from HighVista investor communications, and no obligation to update or otherwise revise such information is being assumed. Historical data, statements, and other information contained herein is believed to be reliable but no representation or warranty is made as to its accuracy, completeness or suitability for any specific purpose. Some information used in the presentation has been obtained from third parties through various published and unpublished sources. HighVista does not warrant the accuracy, adequacy, or completeness of the information and materials contained in this document and expressly disclaims liability for any expressed or implied representations, errors, or omissions in such information, materials or any related written or oral communications transmitted to the recipient. Use of information from sources referenced herein does not represent any sponsorship, affiliation, or other relationship between HighVista and any other company or entity and does not constitute an endorsement. This information does not constitute, and should not be construed as, an offer of advisory services, securities or other financial instruments, a solicitation of an offer to buy any security or other financial instrument, or a recommendation to buy, hold or sell a security or other financial instruments in any jurisdiction. Any reproduction or distribution of this presentation, in whole or in part, or the disclosure of its contents, without the prior written consent of HighVista Strategies LLC is prohibited.

Past performance is not indicative of future results. References to specific securities, issuers, indexes, and strategies are for illustrative purposes only, does not represent any sponsorship, affiliation, or other relationship between HighVista and any other company or entity, does not constitute an endorsement, and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Nothing contained herein constitutes investment, consulting, legal, tax, accounting, or other advice, nor is it intended to be relied on in making an investment or other decision. Information provided herein is based upon HighVista data and analysis and is believed to be accurate as of the time of writing, but no representation or warranty is made herein. Statistical and mathematical measures of performance and risk measures based on past performance, market assumptions or any other input should not be relied upon as indicators of future results. While HighVista Strategies LLC believes the assumptions and possible adjustments it may make in making the underlying calculations are reasonable, other assumptions, methodologies and adjustments could have been made that are reasonable and would result in materially different results, including materially lower results. The strategies described in this presentation may exhibit the potential for attractive returns, however they also involve a significant degree of risk, including the risk of total loss of investment. A broad range of risk factors, individually or collectively, could cause a strategy to fail to meet its investment objectives No investment process, strategy, or risk management technique can guarantee returns or eliminate risk in any market environment.

THIS PRESENTATION CONTAINS FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE U.S. FEDERAL SECURITIES LAWS. FORWARD-LOOKING STATEMENTS ARE THOSE THAT PREDICT OR DESCRIBE FUTURE EVENTS OR TRENDS AND THAT DO NOT RELATE SOLELY TO HISTORICAL MATTERS. FOR EXAMPLE, FORWARD-LOOKING STATEMENTS MAY PREDICT FUTURE ECONOMIC PERFORMANCE, DESCRIBE PLANS AND OBJECTIVES OF MANAGEMENT FOR FUTURE OPERATIONS, PERFORMANCE AND RISK AND MAKE PROJECTIONS OF REVENUE, INVESTMENT RETURNS, RISK CALCULATIONS OR OTHER FINANCIAL ITEMS. FORWARD-LOOKING STATEMENTS CAN GENERALLY BE IDENTIFIED AS STATEMENTS CONTAINING THE WORDS “WILL,” “BELIEVE,” “EXPECT,” “ANTICIPATE,” “INTEND,” “CONTEMPLATE,” “ESTIMATE,” “ASSUME,” “TARGET” OR OTHER SIMILAR EXPRESSIONS. SUCH FORWARD-LOOKING STATEMENTS ARE INHERENTLY UNCERTAIN, BECAUSE THE MATTERS THEY DESCRIBE ARE SUBJECT TO KNOWN (AND UNKNOWN) RISKS, UNCERTAINTIES AND OTHER UNPREDICTABLE FACTORS, MANY OF WHICH ARE BEYOND CONTROL. NO REPRESENTATIONS OR WARRANTIES ARE MADE AS TO THE ACCURACY OF SUCH FORWARD-LOOKING STATEMENTS.